Children and adults love to unpack that bulging stocking that looked so pretty hung by the chimney with care. Usually filled with inexpensive small gifts, fruit and candy, there is always something unusual or special and for women, not necessarily inexpensive. If you are in charge of filling the stockings you may appreciate some stocking stuffer ideas for women.

©bbernard/Shutterstock.com

Before purchasing anything, think about the likes and dislikes of the recipient. Is it your wife, mother, daughter or sister for whom you are stuffing the stocking? This may help adjust your thinking from what you think are good stock stuffer ideas for women to what the woman in your life actually likes. Many women appreciate the thought behind it more than the gift itself.

Gloves for Women

Gloves are a very useful item for fashion as well as warmth. They come in a wide variety of designs, styles and colors from elegant black to comical puppet-like gloves. Knitted fingerless gloves help keep her hands warm while allowing her to use her phone. With such a big selection, you can find just the right style that will please your woman.

We recommend:

Essential Oils for Women

Whether she considers essential oils medicinal or not, there is no doubt they provide a pleasant fragrance. These oils are extracted from plants while retaining the natural smell and flavor of the plant called the essence. With a set of eight essential oils, she can learn about the different uses and choose the ones she loves. If you already know she loves essential oils, this set will be greatly appreciated.

We recommend:

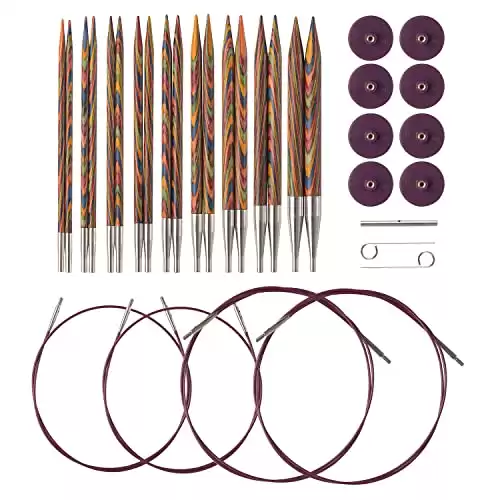

Knitting or Crotchet Needles for Women

Knitting or crocheting is not just for grandma. It’s a relaxing and productive activity that many women enjoy at any age. If a woman loves to knit, she can never have too many supplies. A set of bamboo knitting needles will give her the proper gauge for any knitting pattern. Bamboo is great because it grips the yarn better than metal needles, reducing errors. This is a good stocking stuffer idea for women who are knitting or crocheting experts or beginners.

We recommend:

Manicure Sets for Women

A manicure set stocking stuffer that has everything she needs to have well-groomed finger and toenails is always a winner. You may be tempted to give a gift card for a professional mani/pedi, but that is a one-time deal. Manicure sets are no longer just clippers and nail files. They are chic and useful with cuticle oils, buffers and come in cute carrying cases. You may even help her quit the habit of a salon manicure.

We recommend:

Small Kitchen Gadgets for Women

If you think the last thing she wants is something for the kitchen, think again. Today, kitchen gadgets are state-of-the-art and offer myriad useful possibilities. Consider an automatic pot stirrer with a timer or an al dente waterproof pasta timer that sings when the pasta is cooked to perfection. From a battery operated salt and pepper grinder to a one-click stick butter cutter, there is no end to the fascinating kitchen gadgets available today.

We recommend:

Wine Glass Markers for Women

If she is a wine enthusiast, wine glass markers are a no-brainer stocking stuffer. She may serve wine at a party or even a family get-together where there are eight or more glasses of wine that look exactly alike. You can buy pens that write on glass, but glass charms or glass tags are so much more elegant, cute and useful. They are easy to attach to the stem and each person has a personal design. They even come with holiday designs or just attractive symbols.

We recommend:

Lipstick or Lip Gloss for Women

This is a very personal gift as most women have a color or brand of lipstick that they regularly use. You can either give the exact type she uses or select another brand that has the same general color. If you’re not sure about the shade, try a colorless lip gloss. It’s always useful. Don’t hesitate to ask a friend or relative about giving lipstick if you are hesitant to take a chance.

We recommend:

Hand Sanitizer Lotion for Women

Purse-size hand sanitizer is one of the most useful things to have on hand. There are so many instances when you wish you could wash your hands but don’t have access to soap and water. When in a grocery store or at any shop at the mall are common occasions. Before eating a snack or lunch from a food truck, hand sanitizer is a must. If she works in an office or is a teacher, she may need to clean her hands regularly to avoid picking up germs.

We recommend:

Travel Pill Box for Women

Whether she takes vitamins, pain killers or prescription medication, it’s difficult to keep track of everything while traveling. A travel pillbox is an answer. It’s convenient to carry, with an elegant or cute carrying case, and keeps her medications organized so she doesn’t waste time looking for a pill. In fact, she may find it’s not only good for travel but also good for every day.

We recommend:

Luggage Tags for Women

Sometimes it seems like all suitcases look the same when they are rolling past on the luggage belt. Tape and bows may help or may just get torn off when the bags are loaded in the plane. Luggage tags are made to stay on the luggage and make it easy for her to identify. If travel is a major part of her lifestyle, she will be thrilled to find good-quality luggage tags stuffed in her stocking.

We recommend:

Travel Mug for Women

Travel mugs are designed to allow people on-the-go to enjoy the hot beverages they need. They come in a wide variety of designs with handles and without. They are insulated to keep the coffee, tea, soup or whatever, hot, so you can drink it without spilling it all over your clothes or car. Travel mugs also come in several sizes. The large size is perfect for sharing and the small size is great for that shot of espresso she craves after lunch.

We recommend:

Sleep Mask for Women

A sleep mask has a lot of uses not only for the woman who travels a lot. Along with earplugs, it allows you a dark room to enable sleeping at any time of the day. Sleep masks for women come in a variety of designs and you can stuff several in a stocking. They can match her nightgown or her home décor while still looking glamorous and trendy.

We recommend:

Wine Stopper for Women

The wine aficionado needs as many gadgets as she can get. Stoppers and openers are always useful and make great stocking stuffer ideas for women who love to serve wine. Consider combining the wine glass markers and the stopper that she will be proud to display at her next party or get-together. Wine stoppers come in a variety of shapes, sizes and materials and are needed to close a wine bottle before it is put in the refrigerator.

We recommend:

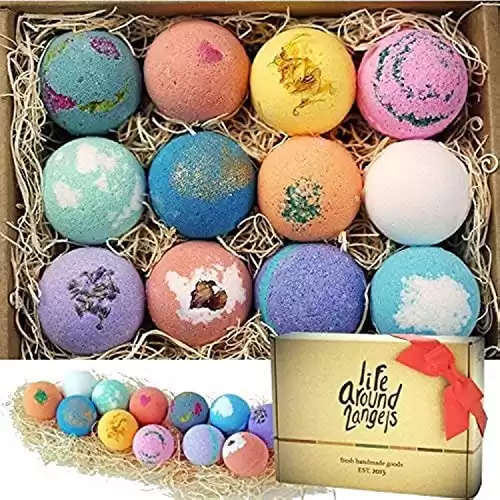

Bath Salts or Bombs for Women

There is nothing like a soak in a hot tub to relax after a long day. Adding bath salts or bombs is the extra care she needs to make the experience perfect. They are made with essential oils that soothe the skin and mineral-rich salts to detoxify and improve circulation. Give her a spa experience at home with a set of healing bath salts in her stocking. A gift box will contain a variety of herbs and fragrances for the extra benefit of aromatherapy.

We recommend:

Earrings for Women

Earrings are one of the stocking stuffer ideas for women where you can go all out. Diamond or pearl studs, crystal drops or gold or silver vintage style, there is no end to the possibilities. This may be the most expensive gift you give and it will be a huge surprise to find it stuffed in a stocking. Even if you prefer something less expensive, earrings are the perfect gift. There is a huge variety of funky or glamorous styles of costume earrings that are inexpensive but don’t look it.

We recommend:

Tea Diffuser for Women

Whether she likes Darjeeling or organic herbal tea, a tea diffuser will give her the perfect cup. You may combine it with some loose leaf tea and a mini honey dipper for a gift any tea-lover will appreciate. A tea diffuser allows her to match the right amount of tea leaves with the right amount of water to make the perfect cup every time.

We recommend:

- Permanent filter that is suitable for brewing tea, coffee, and herbs.

- Brewing Basket is made of stainless-steel micro-mesh in a heat-tolerant frame from BPA-free...

- Lid helps maintain warm temperature for a longer period and can be flipped over and used as a...

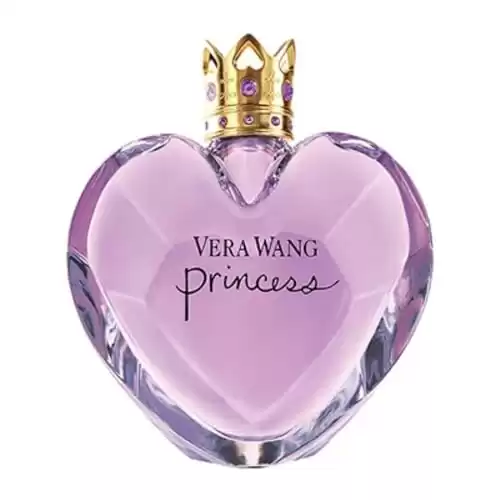

Perfume for Women

Perfume may seem like an obvious stocking stuffer, but it can be really special if you go for an exceptional brand. This is your chance to give her something she may not buy for herself. If she likes one particular scent, you may surprise her with perfume, if she is used to eau-de-cologne.

We recommend:

Scarf (Fashion or Warm) for Women

Scarves are the one accessory that can make or break an outfit. Most women prefer to choose their scarves, but buying one or more for a stocking stuffer is still a good idea. A scarf can be elegant or practical. There are bright and colorful designs for a cold-weather scarf or you may splurge and go for that costly scarf that she admires but would never buy.

We recommend:

The image featured at the top of this post is ©Vasilev Evgenii/Shutterstock.com.